Is Friend Tech a PMF (Product-Market-Fit)?

Long time no see!

I spent my weekend diving down into the PMF topic and also running back my writing routine from this week! Would love to have as much feedback as possible from my readers, which help me to enhance my research, my writing, and my learning skills.

Enjoy it and have a nice weekend.

What is FriendTech?

Simple explanation:

A new decentralized social media application built on Base that earned ~5M revenue in the last 7 days, enabling users to capitalize on their social media presence for monetary gain

And this is how it works

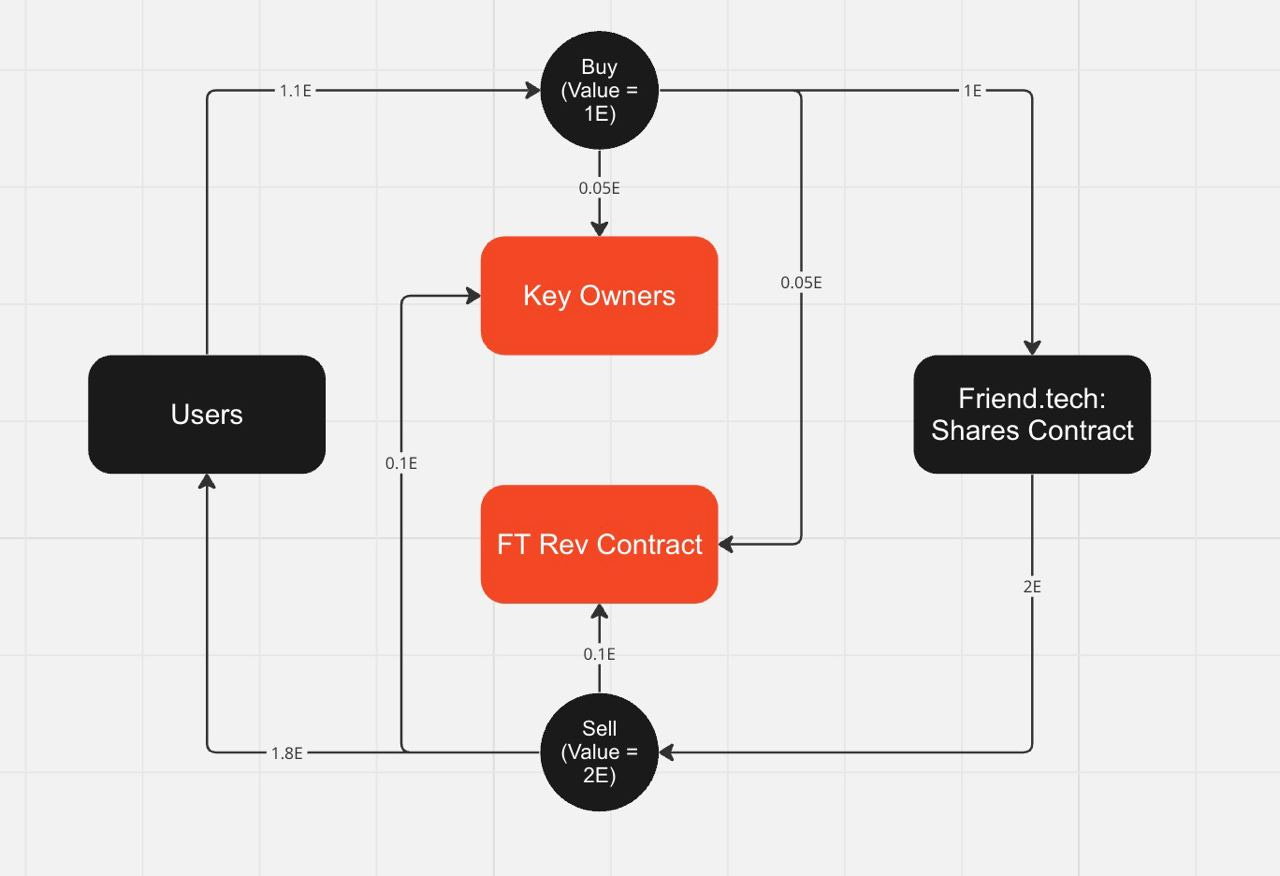

Basically, users can access Friend.tech to buy other’s keys, representing an accessible right to join others’ communities. When users make a buy/sell action, they have to pay a 10% upfront fee, with half of the fee going to key owners and the other half to Friend.Tech, in return for access to key owners’s group chat.

This model is a new kind of mechanism where you can incentivize both parties:

Creators can gain traction (and money) by attracting their followers from multiple social media platforms to join the circle, offering engaging content & games to keep them within it.

Users or traders can have a place to play around, seeking for a “gem” and earning significant profit for getting in early

Friend.Tech is like a game, where each user becomes a token on a mission to identify undervalued tokens in the market and transform them for potential gains.

What is Product-Market Fit (PMF) here and how we can measure it?

Put simply, PMF is the value that a given product provides in addressing the specific market segment’s needs.

Product-market fit is the value that a given product provides in addressing a specific market segment’s need.

In order to measure a product-market fit, analyzing user activity should be the right way to come to your mind. If people like your product, they will continue to use it. And so, before coming to the metrics part, let’s take a look and review the key definition related to user activity in the Friend Tech Case.

What are “active” users in Friend Tech

Currently, when using the product, there are two primary actions that users can take:

Trade shares

Messaging

These two key activities would be our input to define who are the active users sitting in the product. And from these actions, we can diversify them into two separate categories:

Traders - who are actively trading other (or their own) shares on the platform and earning money from the buy/share activity.

Chatting Users - whose main purpose is coming to the product is to use the chat function, interact with their favorite influencers, and receive value from it.

One of the most common misconceptions about a product-market fit is that it’s about everyone. No it isn’t. By clearly defining all user types, we can easily select our target market segment and therefore address that segment’s needs extremely well.

Based on that definition and due to the lack of data in the research part, I will mostly mention traders’ activities in this article and will conduct another one when the data is fulfilled.

Metrics

Let’s come to the boring part, watching metrics. I will review some of the core stats being reviewed every time we research a project.

TVL

Volume & Users

Retention Rate

Total Value Locked

Total Value Locked display the user’s willingness to deposit asset into a platform/protocol. It’s based on the following facts for consideration:

Incentive - Why should I deposit my money into this platform?

Brand - Who is running behind it?

Security - Will by asset be safe?

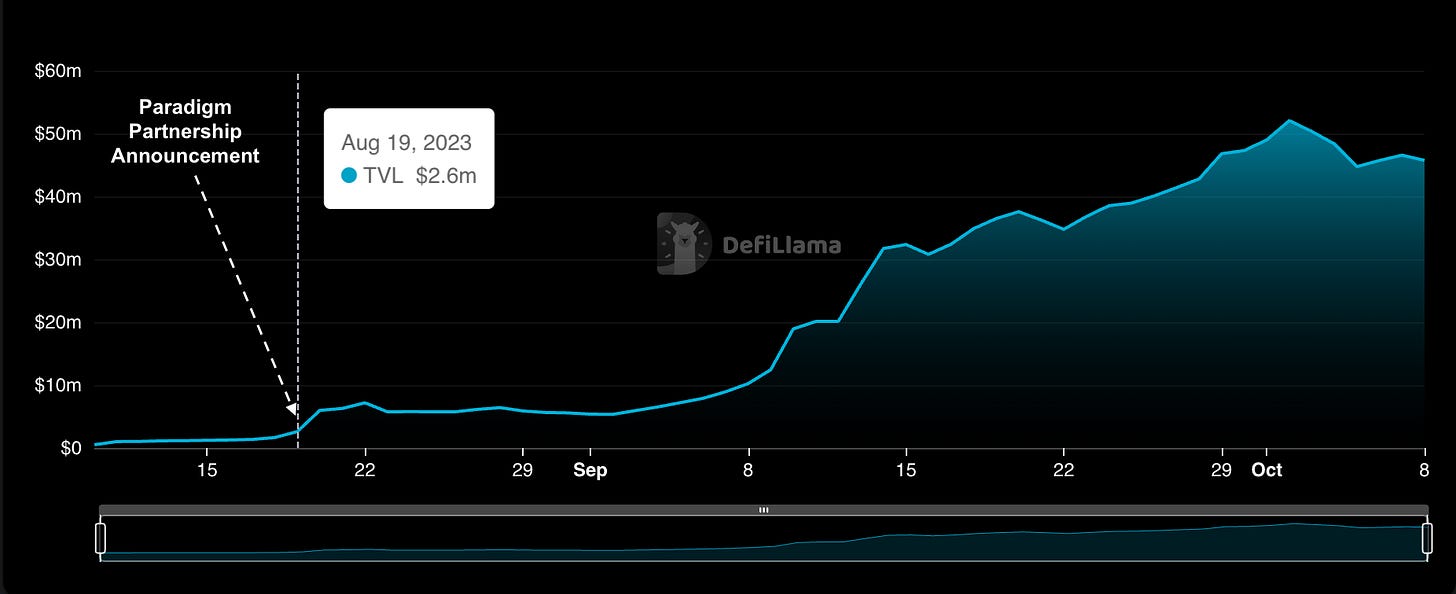

Friend.Tech did great on all the above triangles. It provided Intriguing gameplay where users can deposit money and buy/sell other shares to earn profits. Paradigm is also included in their backer name for satisfaction in branding and security. All of that move facilitating Friend.Tech TVL grew significantly in a short amount of time

1M$ to 5M, an 400% increase in the first month

And from 5M to 50M, 10x growth in September

One of the main reasons helps FT gained massive TVL from the start is their Point-based Airdrop Model, which Blur NFT Marketplace applied. It’s the method that uses points to quantify user’s contribution to a project, and eventually convert them into tokens to reward participants.

Point-based Airdrop Model

For now, FT hasn’t released their token yet. The mechanism they use is quite the same as Blur in the early days since all the activities around the project are based on airdrop speculation. Users calculate potential rewards from the platform then deposit assets and farm the h*** out of it, contributing to the TVL movement.

FriendTech TVL follows the same pattern as Blur in the early stages

Following the impressive beginning, Blur decided to launch their token and the effect it creates is beyond anyone's expectation.

What if FT also launches a token during the same period as Blur 👀 What can happen, no one knows.

My thoughts on FT token launching.

Friend.Tech Team would love to delay the token announcement as long as possible since it’s the primary incentive for attracting many airdrop hunters to participate in the projects. Token launching if not handled well can cause negative effects to the product. Blur is an excellent example of a project launch token applying the Point-based Airdrop model.

Users

Following the definition above about “active” users, we will count all addresses that made at least one transaction buy/sell is a user on Friend.Tech . Below is its performance.

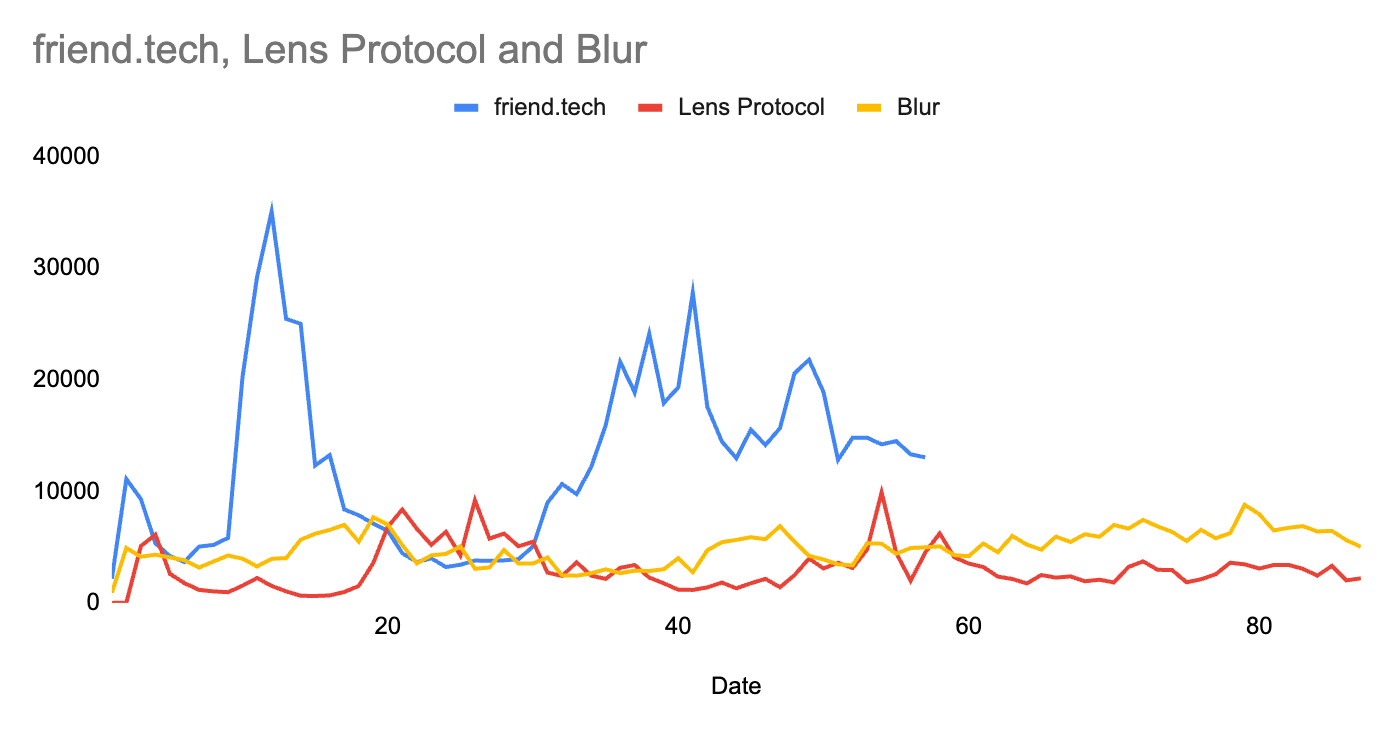

Despite the market conditions, Friend Tech has managed to maintain a user base of 320,000. Its current number of active users remains higher than that of Blur & Lens since its initial days.

We will compare their stats with Blur & Lens Protocol, one is the platform that applied the same bootstrapping strategy and one is the leader in the social landscape before Friend.Tech appears.

We can clearly see that Friend.Tech performs much better than all the two projects at the current stage. However, the view would be more concise if we assessed it within the same timeframe. Let’s take a look at their metrics when three of them just launch.

Seem like users favor Friend.Tech more than two other names at the start, or we can say FT performs their marketing tactics better, especially since we know about their timing at launch.

It’s August 10th, the market lacks excitement, with only a few names crossing the user's mind at this time. Base chain just only appears as a new Layer 2 solution arising from Optimism & Coinbase partnership and their biggest shine was the scammy project BALD with rumored created by a big whale coming from Ethereum.

Retention Rate

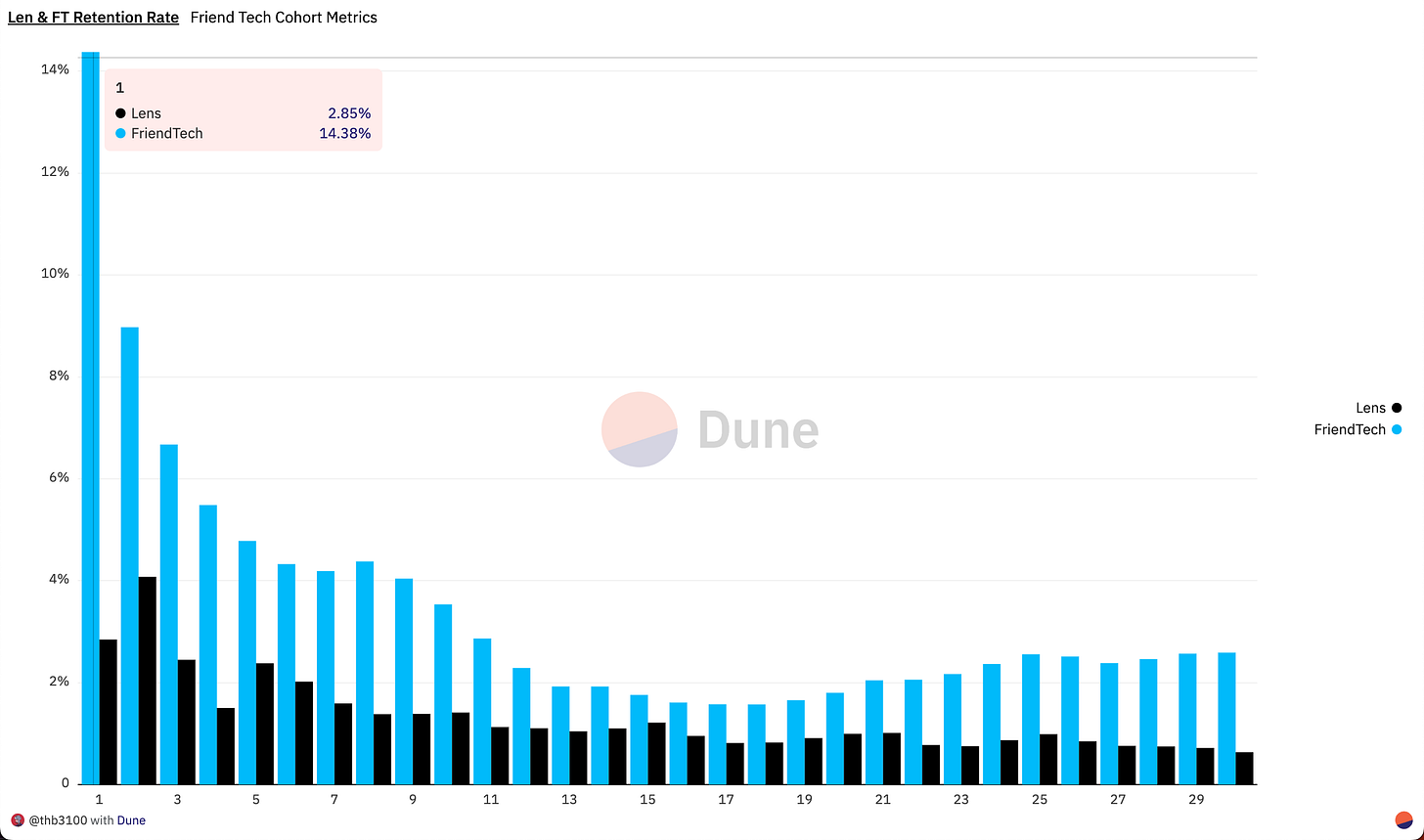

Cohort Analysis is one of the most critical factors when considering a Product market. It explains the portion of users a product retains over time using Retention Rate D7 or D30 (RRD7, RRD30), which stand for the number of the user coming back to the product after 7, 30 days.

The product will grow as long as the number of new user coming to the product are higher than those who churn. Understanding this behavior can help the project enhance its program according to user feedback, which also converts into its retention rate. And the longer they retain their initial user base, the more value they can add to your active users.

The keyholder retention rate remains high at 75% on a daily basis, showing that user’s motivation with the platform is high enough to retain using the service.

Meanwhile, when mentioning trader activities, 15% of them who joined the product came back after 1 day to trade again. This metric is 5 times higher than Lens Protocol.

However, only 5% of them are retained after 1 week, showing that the trading activities are not being considered as the main activity being focused on at Friend.Tech, but rather the messaging one.

Time on site

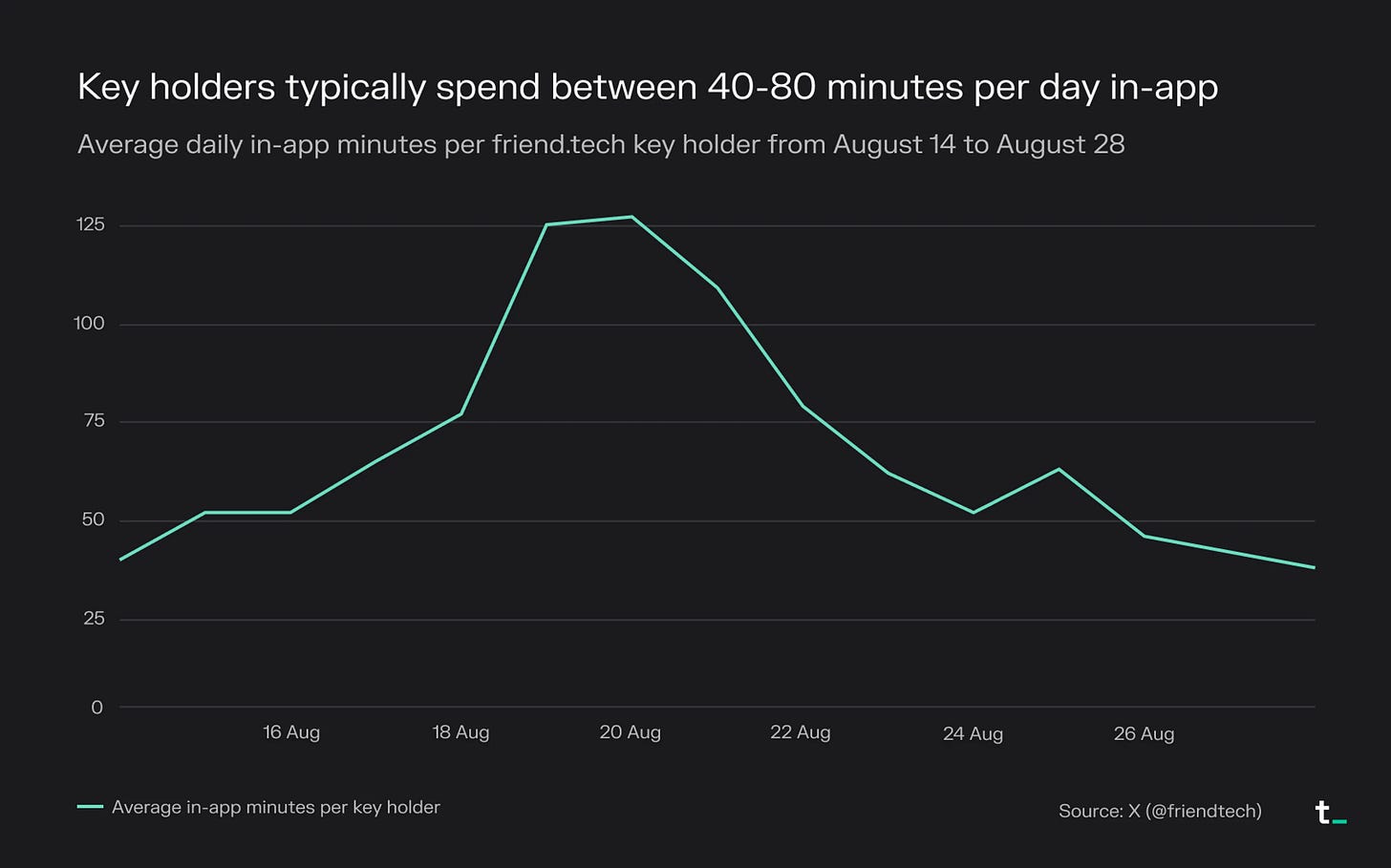

Even though retention indicates whether people find value and comeback, engagement metrics can help review the depth with which people interact with our product. Time on site is one of the common metrics that are used to measure the depth of engagement.

On average, Friend.Tech users spend around 45 minutes per day on the platform. When compared to other platforms like X (31 minutes) and Tiktok (32 minutes), this figure stands out as quite impressive.

Summary

A product-market fit is a really great topic and should be reviewed every time we research and learn about a new project. Friend.Tech provides valuable insights into how a project can thrive in this market, showcasing exemplary marketing strategies. However, determining whether the product has truly achieved market fit requires granting them more time to grow, especially since they only commenced two months ago and still has room for further development.

But after all, some the their key metrics was really impressive:

Almost 20M revenue in only 2 months

Striking user's growth with approximately 10-20k daily active traders

High time on sites showing user’s willingness to stay using the product

There is a sign of a product-market fit. Now, let see how they continue to growth in the future. I will include a more interesting topic about the framework we can use to detect a product-market fit project in the next article.

See you next week!

Harry